Definition:

Market capitalization, also known as “market cap”, is a way to assess the size of a company by multiplying its stock price by the total number of shares.

Understanding market capitalization

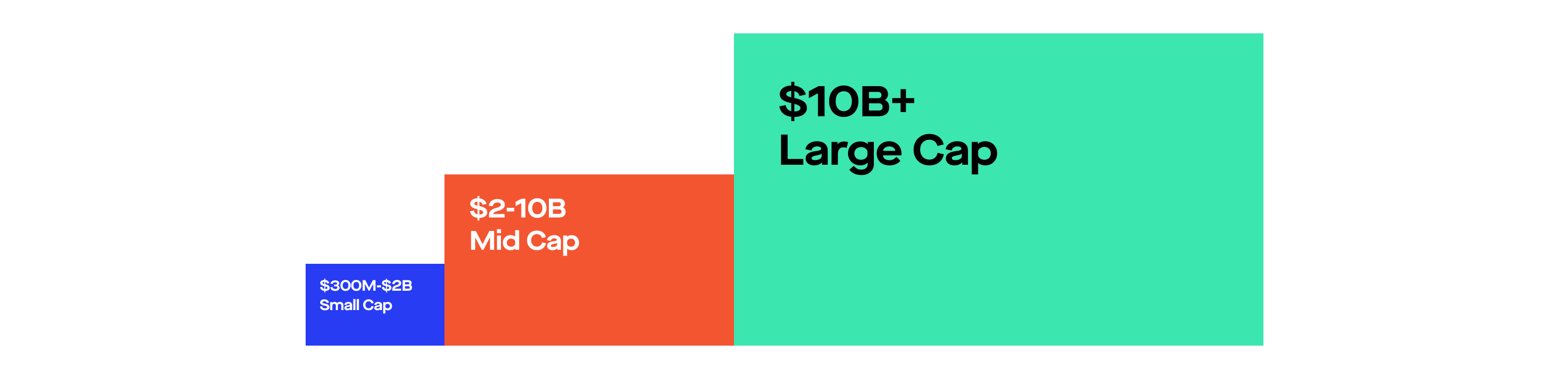

Market capitalization is the dollar value of a company’s outstanding shares. This is calculated by multiplying the total number of shares by the price of each share. As the stock price or the number of shares outstanding changes, the company’s market cap will also change. Companies are categorized into three market cap groups: “small cap” ($300M–$2B), “mid cap” ($2B–$10B), and “large cap” ($10B+).

Example:

Apple made history on August 2nd, 2018 by becoming the first company to reach a $1 trillion market cap. Doing the math: By multiplying its almost 5 billion shares by the $207.05 share price it reached that day, the total came out to $1 trillion. Since then, Amazon and Microsoft have also joined the elite “four comma club.”

Simple Explanation

Calculating market cap is similar to calculating the value of oranges in a crate…

If you need to quickly figure out the value of the crate, just multiply the number of oranges by their price. For example, 300 oranges * $2 = $600. Remember, the number of oranges (and their price) might vary.

Learn more…

How is market cap calculated?

All you need are two numbers to figure out a company’s market capitalization: the total number of outstanding shares, and the current stock price. Market cap is usually used for publicly traded stocks, since the share price of private companies isn’t publicly available. The simplicity of the market cap formula makes it a convenient way to quickly assess the size of different companies, but there are also more nuanced ways to value a company.

Three main categories of market cap:

- Small cap: $300 million – $2 billion

- Mid cap: $2 billion – $10 billion

- Large cap: $10 billion+

While small, mid, and large are the standard categories, there are also labels for the extremes.

- Micro cap: $50 million – $300 million

- Mega cap: Greater than $300 billion

In general, these intervals tend to drift upwards as asset prices increase.

What is the difference between market cap and market value?

Have you ever thought about how much a company could can be sold for? That’s the market value of the company – its worth in the market.

One way for public companies to assess their value is by calculating their market cap.

Private companies face a more nuanced and subjective valuation process. Without publicly-traded shares, it’s hard to determine the exact worth of their shares.

Even for public companies, figuring out their market value can be tricky (i.e. the price another buyer would actually pay for it). Market cap is one way to do it, but there are many other methods to consider. Some methods involve detailed accounting, looking at things like debts, growth potential, and taxes. Other methods are more subjective, considering a company’s ability to innovate and industry trends. Then there are more formula-based approaches, using math to estimate value, like using multiples to turn a known metric into a market value.

Why do market caps matter?

There are two main reasons why investors rely on market capitalization:

- By looking at the market cap, you can estimate the size and maturity of a company.

- The market cap can help you gauge how risky an investment is. Smaller market cap companies might be less established, whereas larger ones could have a stronger market presence.

Why stock splits don’t affect market cap?

When a company decides to lower the price of its stock, it can do a stock split by dividing its shares into smaller portions. It’s similar to slicing a pizza into more pieces without changing the overall size.